IT Asset Disposition, or ITAD, is a procedure built around reusing, recycling, repurposing, or disposing of unwanted information technology (IT) equipment, in a safe and ecologically responsible manner. Most corporations have a cyclical replacement rotation of IT equipment and are regularly faced with decisions related to these end-of-life devices.

Covid’s Effects on the ITAD Market

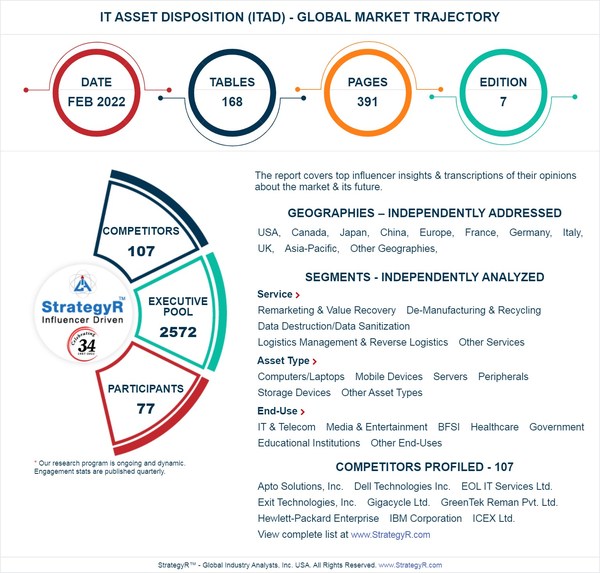

Due to the COVID-19 pandemic, ITAD service markets experienced slowed growth in 2020. However, market trajectories remain highly promising as ITAD services become essential in the modern digital commercial environment.

During the Covid crisis, the global market report for IT Asset Disposition (ITAD) estimates, “that $14.6 Billion dollars in the year 2020, is projected to reach an updated size of $24.5 Billion dollars by 2026, growing at a CAGR of 8.8% over the analysis period.” The compound annual growth rate (CAGR) is the rate of return (RoR) that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span.

Another segment analyzed in the report, “Remarketing & Value Recovery, is projected to grow at a 9.5% CAGR to reach $7.3 Billion by the end of the testing period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the De-Manufacturing & Recycling segment has been changed to a revised 7.9% CAGR for the next 7-year period.” This segment accounts for a 21% share of the global IT Asset Disposition (ITAD) market.

Projected ITAD Growth in a Digital World

A host of factors are expected to enhance the possibilities for the ITAD services market in coming months. The ITAD services market benefits from massive installments of IT systems such as computers and servers, and growing implementation of advanced technologies, shifting towards ‘Smart Factory’ environments.

Smart factories are part of the technological transformation known as the Fourth Industrial Revolution or, Industry 4.0. The first three industrial revolutions; the steam engine, the assembly line, and the computer, completely changed the way people worked and manufactured goods. Today, the fourth revolution is driven by digital and intelligent automation.

Over the past two years, it’s become clear to business leaders that digital transformation is an urgent priority for manufacturing operations. Forbes magazine echoed this, stating “COVID-19 has shown the world something that the manufacturing industry should already know. Traditional supply chains and manufacturing ecosystems are failing, and we need to shift to a more adaptable, agile solution that is fully digitally enabled.” As 2023 begins, ITADs expected growth is already underway.

Government Regulations and the Growth of ITAD

IT asset disposition (ITAD) must adhere to strictly regulated standards relating to environmental concerns and data security. General Data Protection Regulations (GDPR) will have a strong grasp on the future growth of the ITAD services market. In a post COVID-19 period, organizations will be more willing to contract ITAD services such as, “recovery, recycling, data destruction or data sanitization, to manage the waste disposal, restrict the risk of data loss, and the subsequent financial losses, thus giving momentum to ITAD services market.” Businesses and consumers increased need for refurbished IT equipment encourages long-term growth in the market as well. As data-thieves become more skilled, the need for data security on discarded IT equipment is magnified.

ITAD Projects Unique Geographical Needs

Europe and North America are anticipated to have a huge demand for ITAD services in the coming years. Officials are cracking down on regulations and creating legal directives for recovering and reusing materials from e-waste. This is expected to further drive the market. Even larger than Europe and the USA, Asia is expected to experience the highest projections. This is due to enormous amounts of electronic waste, and the availability of inexpensive labor.

The local market is expected to also benefit from increasing collection and recycling of e-waste. However, there are challenges likely to stall the market growth at an international level. Some of these unique challenges include lack of recycling systems, unenforced regulatory policies, lack of e-waste awareness, and insufficient number of e-waste collection centers. In underdeveloped regions, with the lack of policy incentives, it is not uncommon for uncontrolled dismantling, disposal and burning of e-waste.

ITAD Caters to Businesses

ITAD services easily accommodate the various needs of today’s businesses. From processing retired phones, desktop computers, laptops, and servers, to storage devices and other IT assets, ITAD services are multifaceted. Most items that have a cord or battery could utilize ITAD services.

Based on the recent Global Industry Analysts (GIA) findings, when it comes to ITAD services, servers are the largest category needing ITAD solutions. The quickest rising category is represented by mobile devices. Finally, refurbishing computers represents one of the main divisions of the global ITAD recycling market. The largest and most established ITAD service categories are Data Destruction/Data Sanitization and Remarketing/Value Recovery. These two services also represent the fastest growing categories. De-Manufacturing and Recycling, Logistics Management and Reverse Logistics, represent the other major service avenues.

ITAD services are relevant to virtually any branch of industry. Including Information Technology and Telecommunications, Media and Entertainment, Banking and Financial Industries, Healthcare, Government, and Educational Institutions. Banking and Financial Industries denotes over a quarter share of the market. While, Media and Entertainment have become the fastest growing end-use sector.

Looking Ahead

Due to the Covid-19 crisis, global ITAD service markets will continue to surge into the future. Despite the inevitable hurdles which lie ahead, ITAD solutions are still projected to be in high demand. With IT asset disposition being the only ecological solution for retired assets, industries from all sectors inevitably will have to utilize ITAD management. The projection for the future of IT asset disposition services, or ITAD, will continue to have year-over-year growth.