Arconic Separates from Alcoa

Affiliates of New York-based Apollo Global Management, Inc. have agreed to purchase Arconic Corp., a company based in Pittsburgh. The arrangement is an all-cash transaction worth $5.2 billion and will be finalized following the completion of standard definitive agreement procedures.

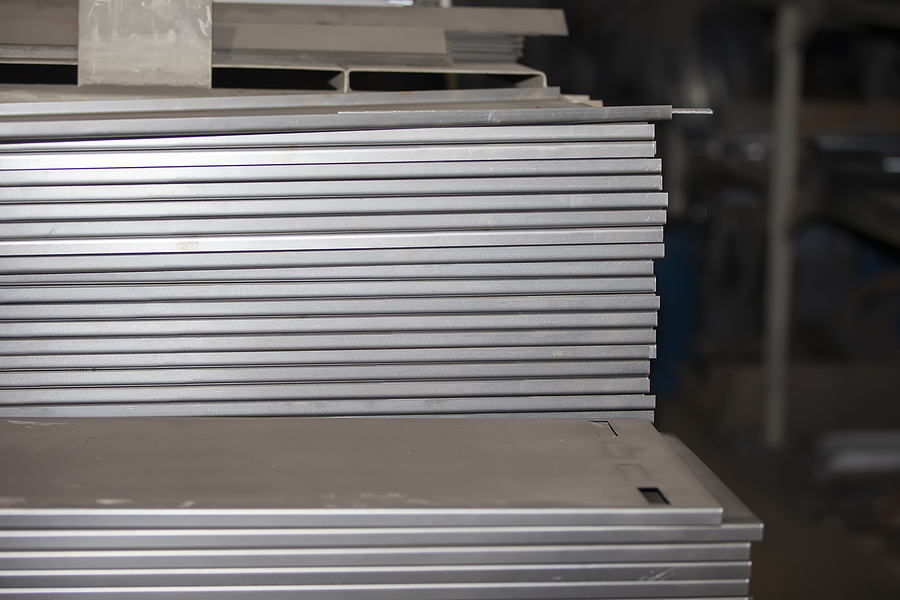

At the start of 2020, Arconic separated from Alcoa and now focuses on producing aluminum sheeting, extrusions, and other goods.

Headquartered in Pennsylvania, Arconic Corp. is run by its Chief Executive Officer Tim Myers. Prior to this role, he served as the executive vice president and group president for the company’s several components that have now been incorporated into a single entity.

“Arconic Corp. has been a leader in aluminum products innovation since its predecessor founded the company in 1888,” Myers said. “Our unique portfolio of assets and dedicated people around the world set Arconic apart from its peers.”

Upon Arconic Corp.’s unveiling, the company has declared that its philanthropic entity, the Arconic Foundation, will continue to provide backing for initiatives designed to equip engineering and manufacturing personnel with the skills necessary for success through the 21st century. These programs look to further cultivate a world class workforce.

GRP Facility in Tennessee

To monitor its progress, in terms of scrap utilization rate across all product lines, Arconic has been diligently attentive at its Global Rolled Products (GRP) facility, located in Tennessee. This site is one of the most comprehensive recycling centers for used beverage cans (UBCs) in North America.

In addition, the GRP facility handles not only UBCs but also Class 1 and 3 scrap sourced from can sheet customers.

Showa Aluminum Can Corp. Joins Group

In the past year, Arconic has been welcomed into the Apollo Group as a portfolio company with Showa Aluminum Can Corp. of Japan. Also, as 2021 came to a close, Showa completed its acquisition of Mitsubishi Aluminum Co. Ltd’s aluminum rolled and extruded products operations.

Apollo says its latest transaction presents a “transformational opportunity for Showa Aluminum to become an integrated, value-added aluminum engineering and packaging group.” The deal also is “representative of Apollo’s increasing private equity activity in Japan, and is the third major corporate carveout transaction for Apollo Funds completed or announced this year,” the equity fund commented.

Apollo Invests in Novolex

Focusing on plastics recycling, at the beginning of 2022, a group of funds managed by Apollo Global made an investment in Novolex. The South Carolina-based manufacturer of packaging products creates using recyclable and compostable raw materials such as fiber, renewable materials, recycled resins, and bio-based materials. By taking majority ownership of the firm, the consortium seeks to develop the sector’s growth potential.

A partner at Apollo, Rob Seminara, stated that, “We are pleased to invest in Novolex, a high-quality, resilient business with a loyal, long-term customer base. The company has a strong management team and is poised to capitalize on growth across food delivery and e-commerce as well as increasing demand for environmentally responsible and compostable products. Importantly, Novolex shares our commitment to sustainability. We look forward to working alongside Stan Bikulege and the rest of the talented management team to create significant value for customers and our investors.”

Stanley Bikulege, Novolex chair and CEO, also explained that “This transaction is a milestone in the Novolex growth story and for the 10,000 families who contribute to our company every day. Apollo offers tremendous resources and expertise and brings significant experience in the packaging industry to the table that will enable us to continue to thrive on the next leg of our journey.”

Arconic to Become a Private Entity

Furthermore, upon conclusion of negotiations, it has been determined that Arconic will cease to have its shares listed on the New York Stock Exchange, and will transition into a private entity. As part of this arrangement, all conditions have been outlined in an agreement between parties.

“In the more than three years since we became a standalone company, we have shown the capabilities and potential of Arconic’s employees and assets,” Myers says. “Our unique product portfolio in an industry with significant potential for growth across the markets we serve positions us to deliver substantial value to our customers and the end users of our products.”

“This transaction represents a realization of value for Arconic shareholders at a meaningful premium and enables the company to execute its long-term strategic vision,” Fritz Henderson, board chair of Arconic, adds.

More Investments to Come

The Apollo Group has identified several strategic investments that deserve consideration, including modernizing “key machine centers” to increase output, incorporating the most up-to-date technology into its plants and processes, and investing in projects which will “provide for a cleaner environment in the communities in which the company operates.”

“Arconic’s talented management team and employees operate a set of premier global assets serving markets that are growing,” Gareth Turner, a partner at Apollo Global Management states. “We are committed to investing significant capital in the company to secure its competitive position and world-class product offering to continue building on Arconic’s journey.”

“As aluminum continues to win share in markets seeking sustainable, high-performing material across a wide variety of applications, we believe there is a strong runway for growth in markets throughout the world. We are looking forward to supporting Arconic’s experienced team with our resources and knowledge in the sector to help the company achieve its long-term goals.”

Arconic Discusses Company Revenue

During the first quarter of this year, Arconic revealed total sales of $1.9 billion, a 12 percent decrease from the prior year, due to the sale of its operations within Russia. The company’s net income also experienced a dip, dropping to $25 million compared to its high of $42 million during Q1 of last year.

Finalization of Apollo’s transaction is projected to occur by late 2021, contingent on Arconic shareholder and regulatory approval. Additionally, funds administered by Irenic Capital Management, located in New York, will enter a minority stake in the arrangement.