IT Asset Disposition (ITAD) Growth Analysis and Market Scope

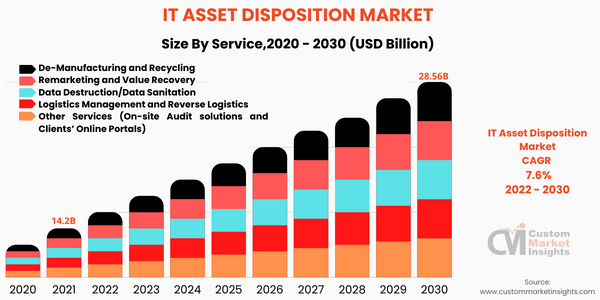

SNS Insider has reported that the IT asset disposition (ITAD) Market is expected to experience a colossal rise in its valuation over the forecast period of 2023-2030. Having been worth USD 15.06 billion in 2022, it is estimated that it will reach an impressive USD 28.43 billion by 2030, with a CAGR of 8.27%.

Fueled by product development and new product releases from leading vendors, IT asset disposition has been experiencing a surge in growth. These endeavors have brought forth more effective products that can give companies an advantage in the market, mainly in terms of energy efficiency.

The ITAD industry has seen an upsurge in demand as more businesses, regardless of size, have begun to make use of IT systems. From small to large organizations, the increased utilization of technology across multiple industries has been a primary driver for expansion within the ITAD sector.

Notable Trends Observed for the IT Asset Disposition (ITAD) Market

During this forecasted period, large-sized enterprises are predicted to demonstrate considerable expansion within the market. This upsurge can be attributed to the growing utilization of IT systems which leads to an increased need for the disposal of outdated and obsolete equipment.

Data segment destruction has seen a significant rise in recent years and is expected to remain so, for quite some time. This uptick can be attributed to advancements in media sanitization, data storage devices, and adoption of cryptographic erase methods.

In comparison to other regions, predictions anticipate that the North American market is currently in a leading position, and is anticipated to maintain its forefront status throughout the forecast period. Such growth can be credited to the continuing installation of IT systems, such as computers and servers, across multiple industries.

Major ITAD Market Players

The report outlines several key market players who have made their mark in terms of sales, revenues, and strategies.

This list includes: Apto Solutions Inc., Dell Inc, Hewlett Packard Enterprise Development, CompuCom Systems Inc., IBM Corporation, Iron Mountain Incorporated, LifeSpan Intern International Inc., Sims Lifecycle Services Inc., Ingram Micro Services, and others.

The Impact of Recession on the ITAD Sector

In recent years, the ITAD sector has experienced notable expansion due to a more pronounced demand for electronic devices, and an urgent requirement for secure and sustainable disposal solutions.

Yet, economic recessions have had serious repercussions on the industry. Data shows that during these periods of financial difficulty, companies are more likely to retain electronic assets instead of discarding them to cut down costs and maximize device lifespans.

Important Developments Related to the ITAD Market

ERI

ERI, a renowned ITAD provider and hardware destruction company located in Fresno, California, is proud to present its propertiary Optech Capture system. This exclusive program has been developed to monitor and record the asset chain of custody throughout the entire ITAD process, and supply ERI’s customers with extensive data and analytics.

“In the ITAD industry, a complete and detailed chain of custody is critical for proper data security and tracking,” states John Shegerian, chairman and CEO of ERI. “We are taking our Optech platform that was already best-in-class and adding a new tool that takes it to a whole new level of excellence. Optech Capture ensures that the chain of custody starts and ends with ERI when it comes to protecting customer data.”

Apto Solutions

Apto Solutions, another industry leader in the field of IT asset disposition (ITAD) services, has recently released its new Environmental Impact Reporting Tool. This unique tool is tailored to assist clients with ESG reporting needs. It gives companies the ability to measure the amount of greenhouse gas emissions that are saved, due to reuse and recycling activities. With this insightful tool, clients can access real-time data to keep track of their progress towards sustainability goals.

“This is a highly dynamic time for ESG compliance, with countless variables that could emerge as the standards become more concrete, from reduced GHG emissions to toxic materials diverted. This tool empowers our customers by putting the data right at their fingertips so that they can use it however they’d like in ESG and Sustainability reports to show the positive impact of their ITAD programs against their other emissions,” explains Apto’s CEO Jeffrey Jones. “And it’s all tied directly into Apto Pulse, so the calculations happen dynamically and are always readily available. No additional work needs to be performed.”

Segmental Overview

The market for IT Asset Disposition has clear segmentation based on asset type and end-use. Of all asset types, computers/laptops held over 40% of the markets value. As businesses are increasingly choosing to refurbish and recycle old PCs and laptops, this is expected to grow notably in coming years.

The mobile device market is experiencing strong growth as well, with the segment for smartphones and tablets predicted to have the highest CAGR during the forecast period. The demand for IT asset disposition services in the mobile device sector is propelled by constant technological advances which bring about new smartphone models, making old devices quickly obsolete.

Conversely, the segment for smartphones and tablets is predicted to expand at a CAGR of over 8% during the forecast period. This growth rate is expected to remain steady over time.

Technological progress has brought about a demand for IT asset disposition services, especially in relation to mobile devices. This development is due to consumers replacing older phones with newer models.

Crucial Questions Answered in the Report:

- What are the (ITAD) IT Asset Disposition Industry’s top companies?

- What is the procedure for getting a free copy of the (ITAD) IT Asset Disposition market sample report and company profiles?

- What are the different categories that the (ITAD) IT Asset Disposition Market caters to?

- What are the primary driving factors that push the (ITAD) IT Asset Disposition market forward?

- What is the size of the (ITAD) IT Asset Disposition market and what is its expected growth rate?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

Significant Offerings:

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by Regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Share, Size & Forecast by Revenue | 2022−2030